Table of Contents

1.0 Declaration ……………………………………………………………………………………….. 11

2.0 Acknowledgements ……………………………………………………………………………. 12

3.0 Abstract ……………………………………………………………………………………………. 13

4.0 Introduction ……………………………………………………………………………………… 15

4.1 Background ………………………………………………………………………………………………… 16

4.2 Research Objectives …………………………………………………………………………………….. 24

4.3 Research Question ………………………………………………………………………………………. 25

4.4 Research Hypothesis ……………………………………………………………………………………. 27

4.5 Recipients for the Research ………………………………………………………………………….. 27

4.6 Suitability of the Researcher ………………………………………………………………………… 28

5.0 Literature Review……………………………………………………………………………… 30

5.1 Introduction ………………………………………………………………………………………………… 31

5.2 Tax Compliance ………………………………………………………………………………………….. 32

5.2.1 Deterrence Effects …………………………………………………………………………………………………. 34

5.2.2. The Impact of Norms on Behaviour ………………………………………………………………………. 36

5.2.3. Fairness and Trust (in the tax administration) ……………………………………………………….. 40

5.2.4. Complexity of the Tax System ……………………………………………………………………………….. 43

5.2.5. Role of Government and Broader Economic Environment …………………………………….. 46

5.3 Tax Planning and Designing the Suite of Property Taxes ………………………………. 49

5.3.1 Household Charge …………………………………………………………………………………………………. 53

5.3.2 Local Property Tax Rationale ………………………………………………………………………………… 55

5.3.3 Thornhill Report …………………………………………………………………………………………………… 58

6.0 Research Methodology………………………………………………………………………. 61

6.1 Introduction ………………………………………………………………………………………………… 62

6.2 Methodology ……………………………………………………………………………………………….. 63

6.3 Research Philosophy ……………………………………………………………………………………. 65

6.4 Methodology selection …………………………………………………………………………………. 69

6.5 Research Approach ……………………………………………………………………………………… 71

6.6 Research Strategy ……………………………………………………………………………………….. 72

6.7 Time Horizons ……………………………………………………………………………………………. 73

6.7.1 Cross-Sectional Time Horizon ……………………………………………………………………………….. 73

6.7.2 Longitudinal Time Horizon ……………………………………………………………………………………. 73

6.8 Data Collection Methods ……………………………………………………………………………… 74

6.9 Data Collection, Editing and Coding …………………………………………………………….. 75

6.9.1 Qualitative Data ……………………………………………………………………………………………………. 75

6.9.2 Quantitative Data ………………………………………………………………………………………………….. 76

Chapter 7 Results and Findings ………………………………………………………………. 78

7.1 Qualitative Data Editing and Coding ……………………………………………………………. 79

7.1.1 Interview Findings…………………………………………………………………………………………………. 79

7.2 Quantitative Data Editing and Coding …………………………………………………………. 81

7.2.1 Questionnaire Findings ………………………………………………………………………………………….. 82

I. General background Information ………………………………………………………………………….. 83

II. Household Charge levels of awareness …………………………………………………………………… 86

III. Local property tax levels of awareness …………………………………………………………………… 91

IV. Perceptions of the uses of the Tax collected …………………………………………………………….. 96

V. Influencing factors on behaviour ……………………………………………………………………………. 98

VI. Participants perceptions of tax and of Revenue …………………………………………………….. 105

VII. Indicators of future compliance …………………………………………………………………………… 113

VIII. Influencing factors on behaviour …………………………………………………………………………. 116

IX. Background payment information ………………………………………………………………………. 121

X. Necessity of assistance …………………………………………………………………………………………. 123

XI. Demographic snapshot ………………………………………………………………………………………… 125

Chapter 8 Analysis and Discussions ………………………………………………………. 128

8.1 Introduction ………………………………………………………………………………………………. 129

8.2 Tax Compliance and Tax Design ………………………………………………………………… 129

8.2.1 Deterrence …………………………………………………………………………………………………………… 132

8.2.2 Norms (both personal and social) …………………………………………………………………………. 134

8.2.3. Fairness and trust (in the tax administration) ………………………………………………………. 134

8.2.4. Complexity of the tax system ……………………………………………………………………………….. 136

8.2.5. Role of government and broader economic environment ………………………………………. 137

8.3 Revenues Developments ……………………………………………………………………… 138

Chapter 9 Conclusion and recommendations ………………………………………… 144

9.1 Introduction ………………………………………………………………………………………………. 145

9.2 Research Objectives Achieved ……………………………………………………………………. 145

9.2.1 Commissioned reports explored ……………………………………………………………………………. 145

9.2.2 Identify the broad factors that determine compliance ……………………………………………. 146

9.2.3 Identify the reasons for the high compliance rates …………………………………………………. 148

9.2.4 Generate theoretical suggestions for future use ……………………………………………………… 149

9.3 Research Hypothesis Testing …………………………………………………………… 152

9.4 Research Recommendations ……………………………………………………………. 152

9.5 Limitations of the Research……………………………………………………………… 153

9.6 The Future Policies for Tax Implementation ……………………………………. 153

Chapter 10 Reflections on Learning ………………………………………………………. 155

10.1 Introduction …………………………………………………………………………………………….. 156

10.2 Learning Style …………………………………………………………………………………………. 156

10.3 Review of Learning ………………………………………………………………………………….. 159

10.3.1 Research Skills …………………………………………………………………………………………………… 162

10.4 Future Applications of Learning ………………………………………………………………. 164

Appendices …………………………………………………………………………………………… 166

Appendix 1: Table of Abbreviations ……………………………………………………………….. 167

Appendix 2: Euros to the Rescue, World Bank 2012/EC ………………………………….. 169

Appendix 3: Eurozone Bailouts – BBC Eurostats 2013 …………………………………….. 170

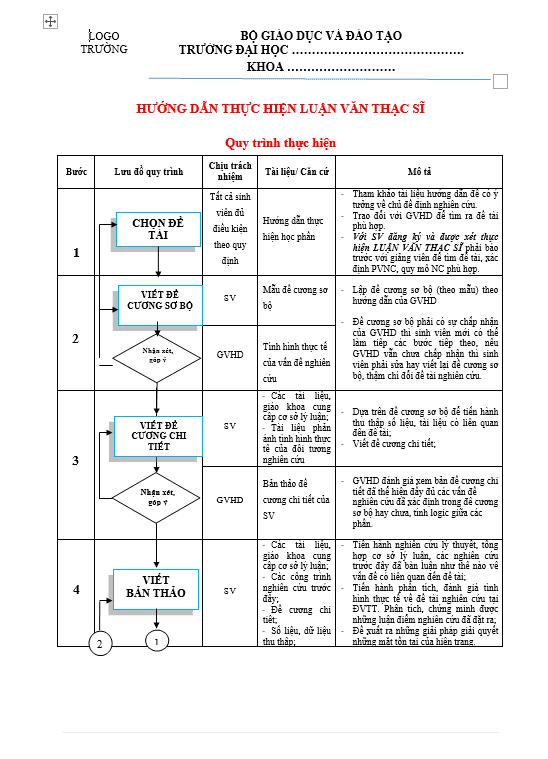

Appendix 4: Dissertation Data Flow ……………………………………………………………….. 171

Appendix 5: The Literature Review Process ……………………………………………………. 172

Appendix 6 : Mind Map for Local Property Tax ……………………………………………… 173

Appendix 7 : Timeline for dissertation ……………………………………………………………. 174

Appendix 8: The Implementation Process of the Property Tax ………………………… 175

Appendix 9: Terms of Reference – Interdepartmental Group …………………………… 176

Appendix 10: Interdepartmental Group Specification of work for the ESRI. ……. 177

Appendix 11: The Property Valuation Bands for Local Property Tax ………………. 180

Appendix 12 : Table of selected International Property Tax Systems ………………… 181

Appendix 13 : Semi-structured Interview Question list …………………………………….. 185

Appendix 14 : Semi-structured Interview Recordings ………………………………………. 187

Appendix 15 : Questionnaire Question- Set ……………………………………………………… 195

Appendix 16 : Honey and Mumford definition (Mobbs, 1982) ………………………….. 204

Appendix 17 : Local Property Tax Project Costings …………………………………………. 205

Bibliography ………………………………………………………………………………………… 206